“The stock market is poised to lose 20%. No, wait, it could lose 30%. Or it could even crash by 50%!”

If you keep up with the news, you’ve most likely read similar “the sky is falling” headlines—the market’s sharp volatility in the first months of 2022 prompted a rash of such pronouncements. So should you panic if you’re retired and have significant amounts invested in the stock market?

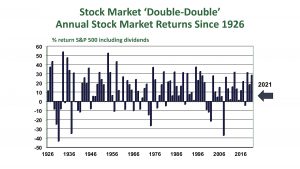

An historical perspective can help calm any jittery nerves you might have. The chart below shows the year-by-year annual returns in the S&P 500, including dividends, since 1926.

The returns in the past three years have been quite impressive: 28.7% in 2021, 18.4% in 2020, and 31.5% in 2019. With this kind of performance, your stock market returns could drop by as much as 20% in 2022 and you’d still have more money than you had a little more than a year ago on January 1, 2021. Lose 30%, and you’d still have more money than you had a little more than two years ago. And lose 50%, and you’d still have more money than you had three years ago.

Looking at a longer time span, in the past 96 years, the S&P 500 has posted a positive return for 71 calendar years and a negative return for just 25 years, for a 71-25 score.

The win/loss ratio isn’t the only impressive score to consider. For the years in which the S&P 500 had a positive return, the arithmetic average of the annual rates of return has been a little over 21 percent. However, for the years in which the S&P 500 lost money, the arithmetic average of the annual rate of loss has only been a little more than 13 percent. So, your average loss for a losing year was more than made up by the average gain for a winning year.

Here are a few ways to put this information into perspective:

- The stock market has gained many more years than it has lost.

- However, the market can be expected to experience losses from time to time.

- If history repeats itself, the average returns during the winning years will more than make up for the losses during the losing years, provided that you remain invested for many years.

- Most of the time, but not always, you’ll earn more money by investing in stocks compared to other investments.

It’s the “not always” conclusion that often causes jittery nerves for retired stock market investors.

But think about this: History has shown repeatedly that the worst thing you can do in a stock market crash is to sell your stock investments when the market is down. If you make that mistake, you’ll lock in your losses, and then you won’t be invested when the market bounces back. Instead, you’ll want to adopt strategies that make you feel comfortable staying invested in stocks while the market drops, even if you’re retired.

Take the necessary time to develop a careful investing and draw-down strategy during your retirement. Work with a trusted and qualified advisor, if that makes you feel more confident. Then you can ignore the sky-is-falling headlines and enjoy your retirement whether the stock market is gaining or losing.