Many workers approaching retirement today haven’t saved enough for the retirement of their dreams. But that doesn’t need to be a bummer: You can take charge of the rest of your life by informing yourself and taking appropriate action steps.

Let’s start by looking at the average benefits today’s pre-retirees might expect.

Most Pre-Retirees Will Fall Short Of Common Retirement Income Goals

Retirement planners commonly recommend that to be comfortable in retirement, you need a total retirement income that replaces 70% to 85% of your gross pre-retirement pay before taxes. These goals are designed to approximately replace all the after-tax, spendable income you enjoyed while you were working. Unfortunately, most retirees will fall short of these goals.

Here’s an example that illustrates the shortfall from this goal that today’s pre-retirees might expect. Let’s look at a hypothetical married couple, Bob and Betty. They’re both age 60, work full time, and can be considered representative of today’s pre-retirees. They’re considering at which age they can afford to retire—62, 65, or 70—so they’re estimating their total retirement income at those ages.

Bob and Betty are examining five possible scenarios:

- Both work until age 62, then they retire full time by starting their Social Security benefits and starting regular withdrawals from their retirement savings.

- Both work part time from ages 60 to 65, then they both retire full time.

- Both work full time from ages 60 to 65, then they both retire full time.

- Both work part time from ages 60 to 70, then they both retire full time.

- Both work full time from ages 60 to 70, then they both retire full time.

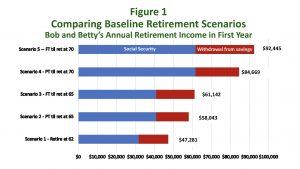

Figure 1 shows estimates of their retirement income under each scenario, combining Social Security income with regular, systematic withdrawals from their retirement savings.

Figure 1 shows that their retirement income increases significantly if they delay their retirement, almost doubling between retiring at age 62 and retiring at age 70. It also illustrates the potential for working part time for a while; there isn’t a big difference in the estimated retirement incomes between part-time and full-time work in scenarios 2 and 3 and scenarios 4 and 5.

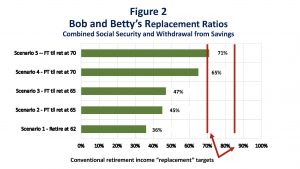

Figure 2 below shows Bob and Betty’s total estimated retirement income as a percentage of their pre-retirement pay (their “replacement ratio”), combining Social Security with their regular withdrawals from savings.

Figure 2 shows that Bob and Betty don’t approach the common replacement goal amounts unless they wait to retire until age 70.

Bob and Betty’s example displays the basic retirement reality facing today’s pre-retirees: They’ll either need to work longer than they’d hoped, reduce their spending in retirement, or some combination. Most of today’s pre-retirees will face the same situation, even though their circumstances might be different from Bob and Betty.

By the way, if you’re interested, I’ve summarized the assumptions made for Bob and Betty’s example at the end of this post.

Action Steps To Prevent Your Retirement Bummer

Of course, your situation will be different from Bob and Betty’s. As a result, the first step is to learn about your own retirement situation:

- Estimate your Social Security benefits using one of the calculators on the Social Security website.

- Take inventory of your living expenses and how they might change in retirement.

- Add up your retirement savings from all your IRAs, 401k accounts, investment accounts, etc.

Then you’ll be ready to consider these action steps:

- Learn how you can increase your Social Security benefits.

- Learn about the various methods you can use to generate regular retirement paychecks from your retirement savings. You might use different methods from the withdrawal strategy that Bob and Betty planned to use; these different methods might produce higher retirement income.

- Investigate ways to work longer and still give yourself time to enjoy life.

- Explore ways to reduce your spending in retirement.

It will take some time and effort to carry out these action steps. If you don’t feel comfortable doing that on your own, you might need to work with a qualified retirement advisor who has your best interests at heart.

I’ve seen several older friends and relatives run low on money in their 80s, experiencing their own retirement bummer due to making uninformed decisions at the time they retired. To avoid their fate, it’s well worth the effort to plan ahead—your quality of life and financial security for 20 to 30 years is at stake.

Assumptions for the example

Here are my assumptions for Bob and Betty’s situation:

- They each earn $65,000 per year, a little higher than the average wages covered by Social Security. As a result, their household income is $130,000 per year.

- They’ve saved $500,000 for retirement, significantly higher than the median savings $204,000 for households aged 55 to 64, according to one report.

- Neither have earned a traditional pension benefit.

- The amounts shown in Figure 1 are expressed in today’s dollars and aren’t adjusted for inflation.

- Their savings earn 3% per year, after inflation, until they retire.

- When they work part time, they’ll no longer contribute to their retirement savings. When they work full time, they’ll contribute a total of 15% of their pay to retirement savings, which includes their employer’s match.

- To calculate their annual withdrawal from savings, they use the methodology of the IRS required minimum distribution. This is a conservative withdrawal method that’s intended to produce retirement income for life, although there’s no guarantee that will happen.