Most of today’s pre-retirees and retirees will fall short of the retirement income replacement goal that’s commonly advocated by retirement planners. According to planners, you need a gross retirement income from all sources that ranges from 70% to 85% of your preretirement pay; attaining that goal will replace all your after-tax, spendable income while you were working.

The trouble is, most of today’s pre-retirees haven’t saved enough money to meet that goal if they retire at age 65, when they combine the retirement income from their savings with their expected Social Security benefits. Consequently, they face a potentially tough choice: work beyond age 65, reduce their spending compared to their working years, or some combination of the two.

Another challenge with the goal is that it duplicates your life while you were working. However, your life will most likely change significantly in retirement.

This post focuses on ways to reduce your spending in retirement while planning for a fulfilling retirement.

How Much Do Retirees Spend On Average In Retirement?

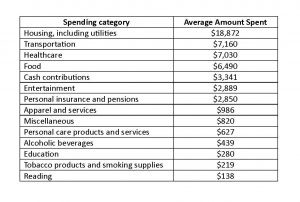

U.S. households headed by someone age 65 and older spent $52,141 per year on average on expenses ($4,345 per month), according to the 2021 report on consumer expenditures prepared by the U.S. Bureau of Labor Statistics. It’s insightful to see the breakdown of the average annual amount spent, itemized according to the type of expenditure, from highest to lowest:

This breakdown shows that the largest potential targets for spending reductions, in order, are housing, transportation, healthcare, food, cash contributions (charitable donations), entertainment, and personal insurance.

What Are Some Common Fixed And Variable Expenses In Retirement?

When discussing your spending, many planners distinguish between your basic living expenses, i.e. “needs,” and your discretionary living expenses, i.e. “wants.” Your needs often include housing, transportation, utilities, food, medical bills, and medical insurance premiums. Your wants often include entertainment, contributions, and various discretionary expenses. In theory, you could spend less money on your wants if money is tight.

However, real life isn’t quite so black and white. For example, it’s possible that you may be spending a lot more on housing, transportation, and food than was absolutely necessary. If your budget’s really tight, you’ll want to take a close look at items that might be considered “needs” to see if you can save money.

How Do You Know If You’re Spending Too Much In Retirement?

The first step to determining if you’re spending too much money is to consider any retirement savings you’ve built up as a generator of a monthly lifetime retirement paycheck, then you just spend that monthly paycheck on living expenses. Don’t think of your savings as a pot of money or a checking account that you can spend as you please on your living expenses.

You’re spending too much money if you’re regularly spending more than your total lifetime retirement income from all sources, including Social Security, pensions, the retirement paycheck generated by your savings, and any other regular retirement income.

If you’re spending too much money, sooner or later you’ll run out of savings. Then you’ll be old and poor—not a good situation. You’ll be much more secure if you plan ahead by reducing your spending now, before it’s too late. Then you have a better chance of living a financially sustainable retirement.

What Are Realistic Ways Retirees Can Spend Less?

If there’s a large gap between your regular retirement income and your regular spending in retirement, you’ll need to look at the big spending targets that you might be able to reduce, such as housing, transportation, food, and contributions.

For example, can you save money by downsizing, getting by with just one car, or using public transportation? Can you spend less money on food by shopping for bargains, buying less-expensive food, or shopping at discount markets?

Often you can create win-win solutions, such as downsizing to a home that lets you spend less money on transportation or buying less-expensive food that also happens to be healthier for you.

What Are Tips To Ensure Retirees Stick To New Reduced Spending Habits?

It can be difficult for some people to change their ingrained spending habits. Considering the examples of your older relatives and friends is a behavior-change technique that can boost your motivation. For example, do you have any older relatives or friends who ran out of money in their 80s? My wife and I have seen that happen with a few of our neighbors who stayed too long in a big house they couldn’t really afford. They were forced to move when they were running out of money, and they were quite frail at that time. They had to rely on family to help them make the move, and it was a rough time for their entire family.

Rather than be depressed about reducing your spending, however, you should consider this situation to be a chance to find win-win solutions that save you money and improve your life in retirement. Instead of being complacent, take action steps to enjoy a much happier and sustainable retirement.